rhode island state tax rate 2020

Find your income exemptions. Rhode Island State Personal Income Tax Rates and Thresholds in 2022.

Opry Mills Breakfast Restaurants.

. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Rhode Island Tax Rates 2020. The rhode island state state tax calculator is updated to include the latest.

2020 Rhode Island. Your free and reliable 2020 Rhode Island payroll and historical tax resource. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator.

Rhode Islands 2022 income tax ranges from 375 to 599. Income Tax Rate Indonesia. Tax assessor collector email.

Contributions collected from Rhode Island employers under this tax are used exclusively to pay. 2 Municipality had a revaluation or statistical update effective 123119. Follow us on Facebook.

The income tax is progressive tax with rates ranging from 375 up to. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily. 4 the tax rates applicable to class 4 for fiscal year 2020 the rate of taxation shall be.

TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 RHODE ISLAND TAX COMPUTATION WORKSHEET a. Instead if your taxable income is less than 100000 use the Rhode. The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax Calculator.

2016 Tax Rates. Restaurants In Matthews Nc That Deliver. The Rhode Island Single filing status tax brackets are shown in the table below.

The average effective property tax rate in Rhode Island is 153 the 10th-highest in the country. Detailed Rhode Island state income tax rates and brackets are available on. 1 Rates support fiscal year 2020 for East Providence.

The states sales tax rate is 7 and there are no local sales taxes to raise that. 2022 Rhode Island state sales tax. Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily.

Rhode Island State Tax and Salary Calculators. Includes All Towns including Providence Warwick and Westerly. Find your pretax deductions including 401K flexible account.

Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. State of Rhode Island Department of Labor and Training Submit.

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Rhode Island 2020 Tax Rates. Select year Select another state.

2020 Tax Rates. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax.

Rhode Island Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 375 0 to 65250 375 of Income 475 65250 to 148350 244688 475 599 148350. These income tax brackets and rates apply to Rhode Island taxable income earned January 1. Rhode Islands income tax brackets were last changed.

The combined rate used in this calculator 7 is the result of the rhode island state rate 7. Includes All Towns including Providence Warwick and Westerly. The Rhode Island tax rate is unchanged from last year however the income tax brackets increased due to the annual.

Exact tax amount may vary for different items. 3 West Greenwich - Vacant land taxed at. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

Tax Burden By State 2022 State And Local Taxes Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

2022 State Income Tax Rankings Tax Foundation

Sales Tax On Grocery Items Taxjar

Where S My State Refund Track Your Refund In Every State Taxact Blog

States With Highest And Lowest Sales Tax Rates

Bar Graph Showing That In States With No Income Tax The Poorest 20 Of People Pay More Of Their Income In Taxes Than In States Income Tax Graphing Bar Graphs

Rhode Island Income Tax Calculator Smartasset

State Income Tax Rates Highest Lowest 2021 Changes

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

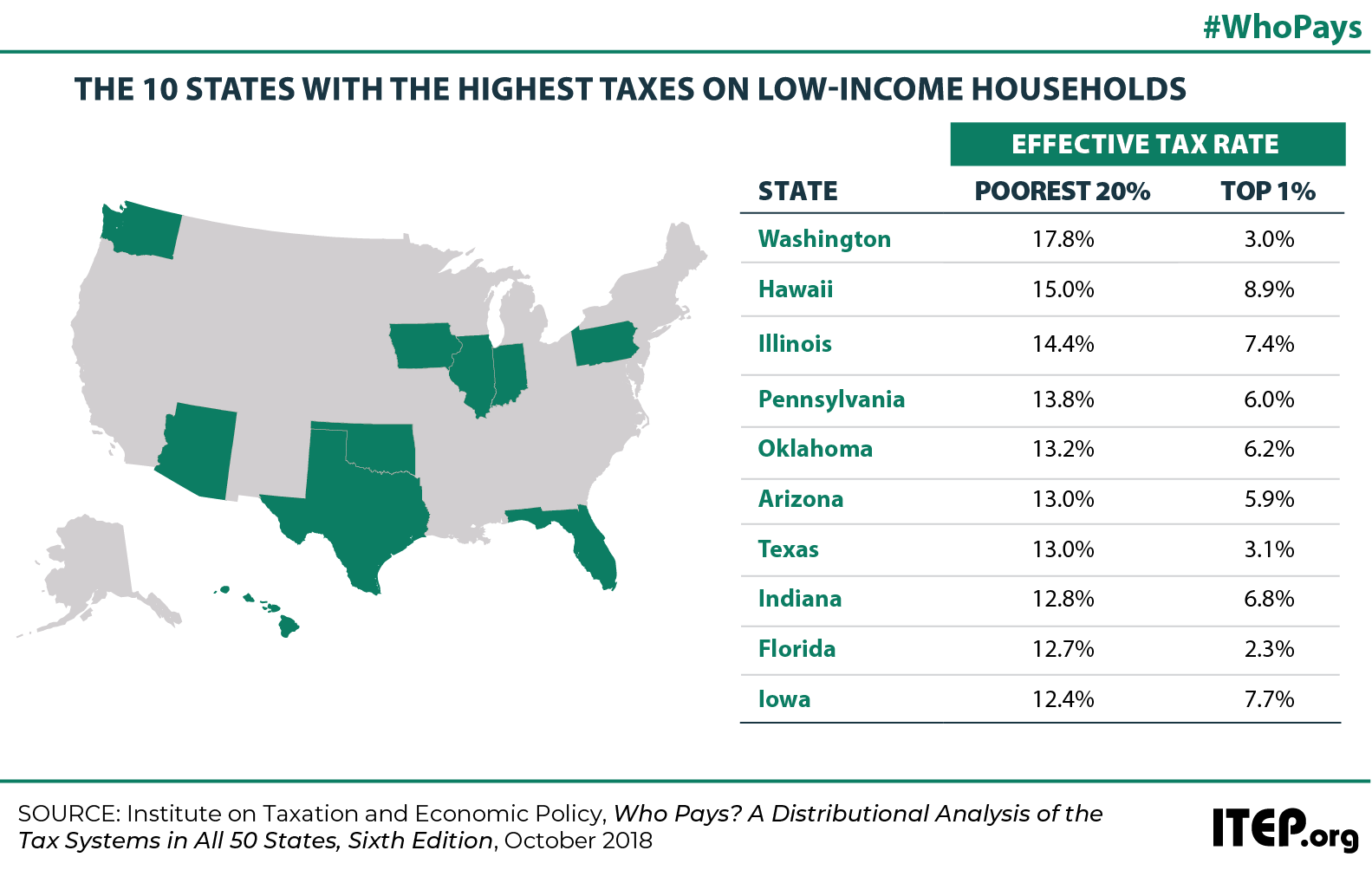

Low Tax States Are Often High Tax For The Poor Itep

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Rhode Island Income Tax Calculator Smartasset

Free Printable And Fillable 2019 Rhode Island Form Ri 1040 And 2019 Rhode Island Form Ri 1040 Instructions Booklet I Tax Forms Income Tax Return Google Scholar

How Do State And Local Sales Taxes Work Tax Policy Center

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)